Humacyte Rings the Bell As New Public Company

Representatives from Durham-based regenerative medicine company Humacyte got the chance to ring the August 30, 2021 closing bell at the Nasdaq stock exchange, signifying completion of its business combination with Alpha Healthcare Acquisition Corp. (AHAC).

The deal means about $245 million in additional funding for Humacyte, including $175 million in PIPE (private investment in public equity) financing and $70 million in cash held in a trust account by AHAC, a New York-based special purpose acquisition firm. The combination will give the new public company – traded on the Nasdaq Global Select Market under HUMA and HUMAW – a market capitalization of close to $1.1 billion.

Humacyte is developing a technology platform that can create bioengineered, off-the-shelf replacement human tissues and organs. The company said the acellular tissues are designed to treat a wide range of diseases, injuries and chronic conditions.

The technology is based on research at Duke University by Laura Niklason, M.D., Ph.D. – a a leader in tissue engineering – and scientists Shannon Dahl and Juliana Blum, and Niklason’s prior research at the Massachusetts Institute of Technology.

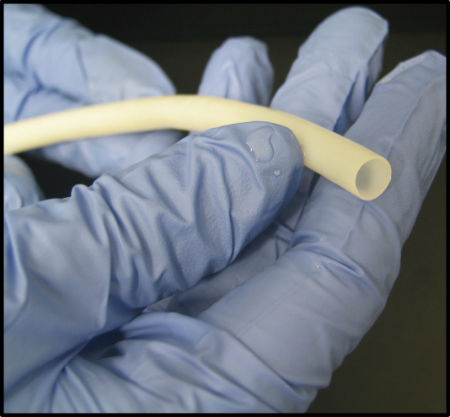

It uses banked human vascular cells as seeds to create extracellular, matrix-based tissues that can be formed into tubes, sheets or other shapes with properties similar to native tissues. The vascular cells are then removed to avoid triggering an immune response or infection in patients receiving the engineered tissue, which is designed to be stored in hospitals and surgical centers and immediately available.

Niklason founded the company in 2004 and will remain its chief executive officer. She is one of only a handful of women in history to start a biotechnology company that she also took public as CEO at a valuation exceeding $1 billion, according to Humacyte. Kathleen Sebelius, former secretary of the U.S. Department of Health and Human Services, is the newly appointed chair of Humacyte’s Board of Directors.

The North Carolina Biotechnology Center supported the company’s early development with a $150,000 Small Business Research Loan in 2006.

HAVs in late-stage development

Humacyte’s most advanced product candidate is Human Acellular Vessels (HAVs). HAVs are off-the-shelf vessels that can be used for vascular repair, reconstruction and replacement. They can be manufactured in commercial volumes, potentially eliminating the need to harvest vessels from patients. Clinical evidence also suggests that HAVs are infection-resistant, non-immunogenic, and can become durable living tissue.

“Humacyte is poised to make commercial-scale bioengineered tissues a reality for patients,” Niklason said. “We enter the next phase of our transformation of regenerative medicine as a robust public company, evaluating our first-in-class bioengineered HAVs in numerous indications.”

Rajiv Shukla, chairman and CEO of AHAC, said Humacyte’s platform is aimed at solving intractable medical problems. Patients can benefit from a lower risk of amputation and tissue rejection, the elimination of waiting times and reduced need for immunosuppression and additional surgeries. Physicians can achieve better clinical outcomes and payors can save money by avoiding amputations and infections, additional surgeries, medication and re-hospitalizations. “I’m excited to work with the Humacyte Board and team to fulfill this vision,” Shukla added.

Humacyte’s HAV technology currently is under evaluation in late-stage clinical trials for vascular trauma and arteriovenous access. The company is on track to have its first commercial product within two years, after receiving Fast Track and Regenerative Medicine Advanced Therapy designations from the U.S. Food and Drug Administration.

Longer term, Humacyte could create solutions for complex organ disease, including bioengineered replacement tissues and organs for coronary artery bypass grafts, pediatric heart surgery and type 1 diabetes treatment. The potential market for the company’s products is estimated at $150 billion.